what items are exempt from sales tax in tennessee

This page discusses various sales tax exemptions in Tennessee. The due date for the sales and use tax return is the 20th of the month following the end of the reporting period.

Tennessee Sales Tax Handbook 2022

This page discusses various sales tax exemptions in Texas.

. Tennessee Sales and Use Tax Return These instructions apply to Tennessees sales and use tax return for periods beginning on or after January 1 2020. Several examples of items that are. In Texas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Counties and cities can charge an additional local sales tax of up to 15 for a maximum possible combined sales tax of 75. Sales Tax Exemptions in Tennessee. Sales Tax Exemptions in Texas.

Click here for more information what items are tax-exempt during this holiday. Additionally the state levied 18centpergallon excise taxes on gasoline and diesel fuels. Florida has 993 special sales tax jurisdictions with local sales taxes in addition to the.

Groceries and prescription drugs are exempt from the Florida sales tax. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975. A sales tax is a tax paid to a governing body for the sales of certain goods and services.

Tennessee has a lower. In 2010 the Legislature enacted the fuel tax swapa combination of sales tax and excise tax changes designed to give the state more flexibility in. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945.

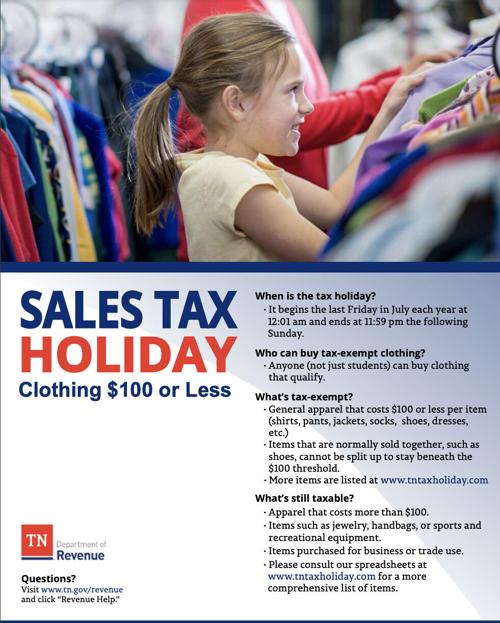

Tennessees traditional sales tax holiday on clothing school supplies and computers begins at 1201 am. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. Different Sales Tax Rates Apply to Fuel.

Prior to 2010 California applied the same sales tax rate to fuel as it did to other goods. On Sunday August 1 2021. While the Tennessee sales tax of 7 applies to most transactions there are certain items that may be exempt from taxation.

Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchaseWhen a tax on goods or services is paid to a governing body directly by a consumer it is usually called a use taxOften laws provide for the exemption of certain goods or services from sales and use. Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. In Tennessee certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

An example of an item which is exempt from Texas sales tax. On Friday July 30 2021 and ends at 1159 pm. While the Texas sales tax of 625 applies to most transactions there are certain items that may be exempt from taxation.

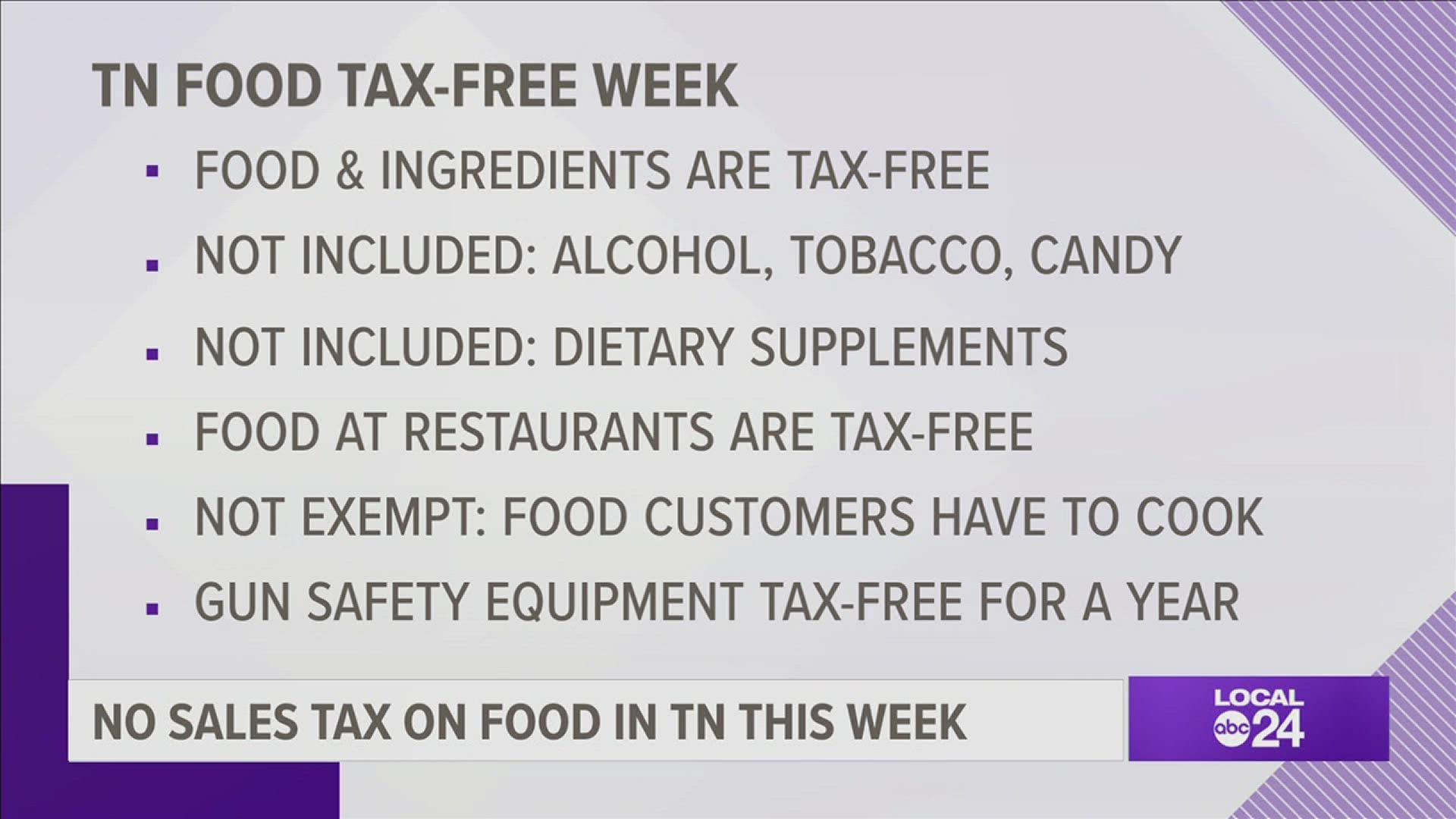

Tn Has Its First Ever Tax Free Week On Food Localmemphis Com

Tennessee S Tax Free Weekend 2021

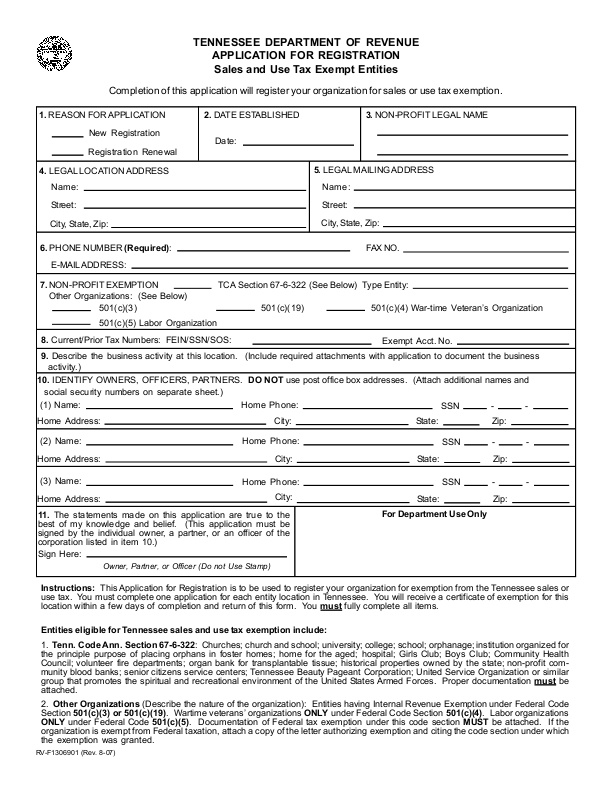

Tennessee Department Of Revenue Application For Registration Sales And Use Tax Exempt Entities Icma Org

Tennessee S Tax Free Weekend 2021the Official Pigeon Forge Chamber Of Commerce

7 Non School Items To Buy During Tax Free Weekend Williamson Source

Tn 3 Day Sales Tax Holidays Food Gun Equipment School Supplies 2021 2022 Schools Open House Dates Smokey Barn News

Jackson Tennessee Tennessee Tax Free Weekend

Sales Tax Holidays Are Underway This Weekend In Tennessee News Timesnews Net

Is Food Taxable In Tennessee Taxjar

Tennessee Sales Tax Small Business Guide Truic

List Of Tax Exempt Items Baby Receiving Blankets Emergency Kit Receiving Blankets

Shop Until You Drop During Your State S Tax Free Holiday Tax Holiday Tax Free Weekend Tax Free

Computer Glitch At Ingles Charging Sales Tax During Tennessee Tax Free Holiday Wcyb

7 Things You Don T Know About The Tennessee Tax Free Weekend

Sales Tax On Grocery Items Taxjar

Get Ready To Save Tennessee Department Of Revenue Announces Three Tax Saving Holidays This Year Smith County Insider

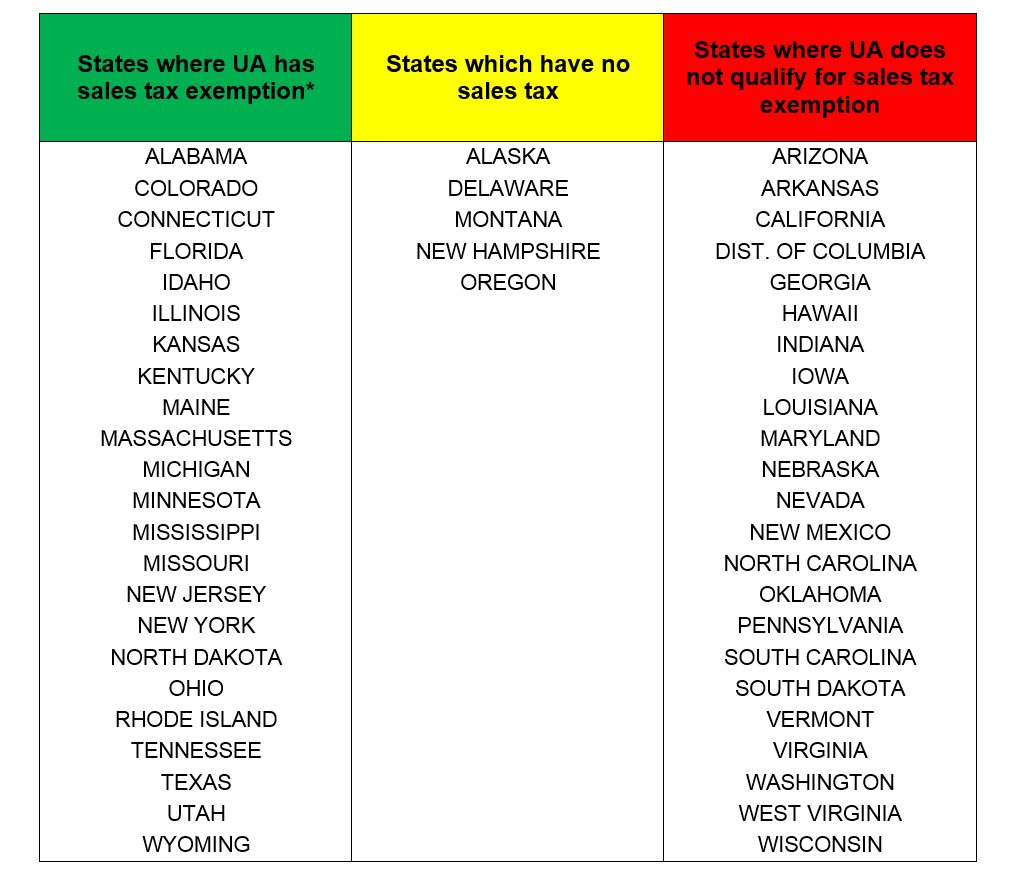

Other States Tax Exemption Tax Office The University Of Alabama